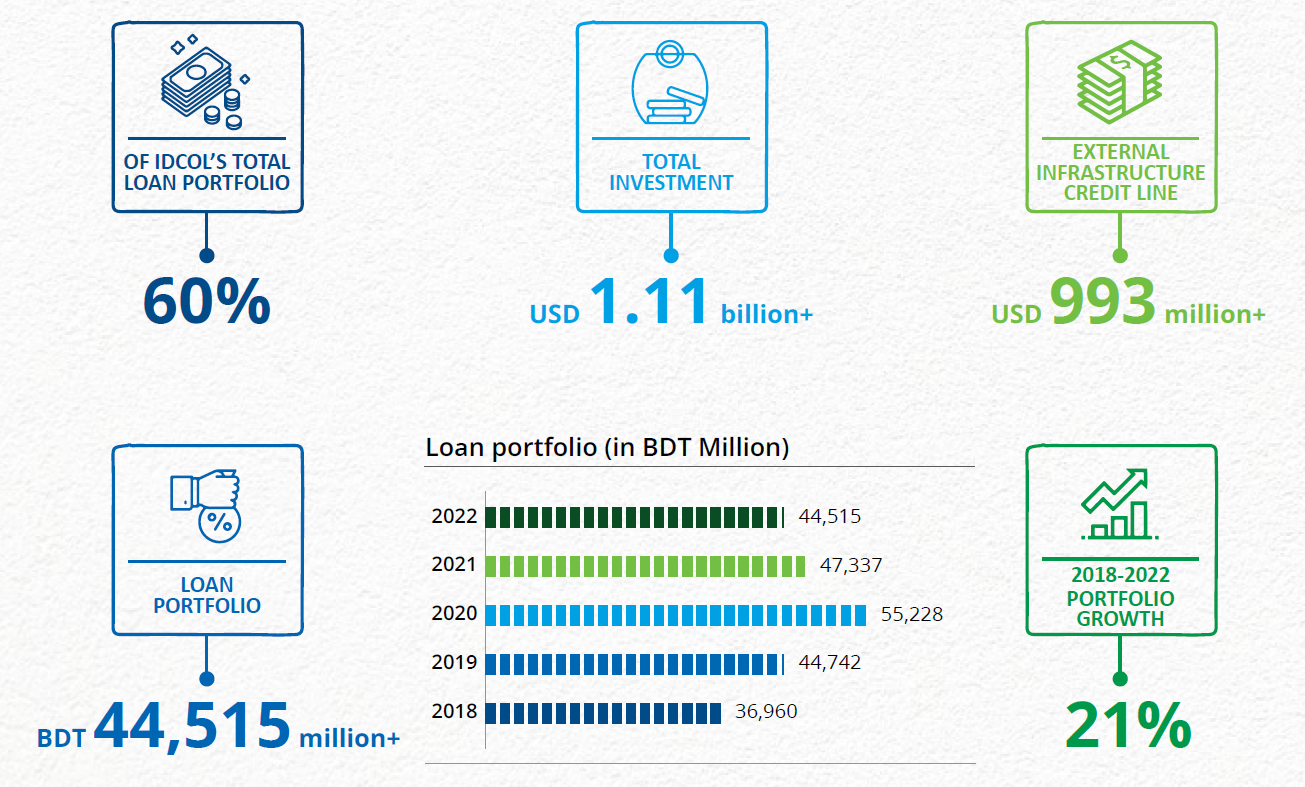

The loan portfolio of IDCOL’s infrastructure and PPP segment stood at over BDT 44.50 billion as of December 2022 – contributing around 74% of the organization’s total loan portfolio. The portfolio composition has been historically skewed towards the power sector – representing IDCOL’s expertise in power project financing. However, in recent years IDCOL has been focusing on diversifying its portfolio by adding new sectors to minimize concentration risk. Apart from power, IDCOL has successfully included social infrastructure, hotel and tourism, economic zone, gas & other fuel based infrastructure, infrastructure backward linkage - sectors to its portfolio mix. IDCOL’s sectoral outlook has a substantial impact on private sector development. By leveraging its sectoral competencies and utilizing emerging opportunities across sectors in Bangladesh, IDCOL can continue the growth trajectory it has charted in recent years. In 2023, IDCOL aims to increase its infrastructure and energy efficiency exposures. In the area of energy efficiency, IDCOL may deepen expansion into cement, textiles, RMG under the industrial component as it has the support of concessionary funding line. In 2022, IDCOL secured credit line from AIIB, ADB and KfW which will be used in upcoming infrastructure projects and energy efficiency projects respectively in 2023. Although the power portfolio is likely to undergo a reduction in share over the mid-term due to the phasing out of fossil fuel-based investments, IDCOL may prioritize financing combined cycle gas based power plants in line with broader development plans.

Emerging Areas of Investment:

IDCOL is considering tapping into opportunities in emerging areas of importance that complement its development mandate as well as offer commercial scope in Bangladesh, subject to further feasibility studies. The following areas are currently being explored for profitable business opportunities.

1. Social infrastructure

Given the need for upgrading health infrastructure in Bangladesh as well as frailties in the healthcare system exposed due to the pandemic, IDCOL may consider a strategic presence in this sector which currently sees robust private sector involvement. The demands of the education infrastructure may also warrant a closer look. Both these areas are amenable to PPP structures for financing subject to suitable project development and design by the private sector.

2. Electric Vehicles

An upcoming area in sustainable financing, electrification of vehicles is a worldwide phenomenon to reduce the burden of emissions caused by fossil fuel operated vehicles. IDCOL has already initiated groundwork of demand assessment of enterprises for EV and may consider financing EV manufacturing and other allied support infrastructure in the mid-term.

3. Climate Change Financing

Climate finance flows through established funds and agencies is expected to accelerate in the mid-term. IDCOL is already supporting implementation of projects under GCF and can leverage its expertise to explore opportunities for climate change financing in other areas as well such as transportation and green building infrastructure. Closer association with GCF as well as other DPs such as the ADB who offer climate related financing and understanding of their concessional instruments, including low-interest and long-tenor project loans, lines of credit, equity investments and risk mitigation products such as guarantees, as well as any grant-based capacity-building interventions will help to sustain these investments further.